The upgraded transportation system in Houston has made a big impact on real estate prices. Properties near major highways, METRORail stops, and Transit-Oriented Developments have seen their value shoot up. The better access and connections brought by improvements like the METRORail and toll roads haven't just raised property prices but have also sparked more interest in these well-linked areas.

Consequently, neighborhoods with efficient transportation options have experienced a steady rise in real estate values, drawing in buyers and investors. The close interplay between transportation infrastructure and real estate prices in Houston paints a fascinating picture of how the city's property market is shaped.

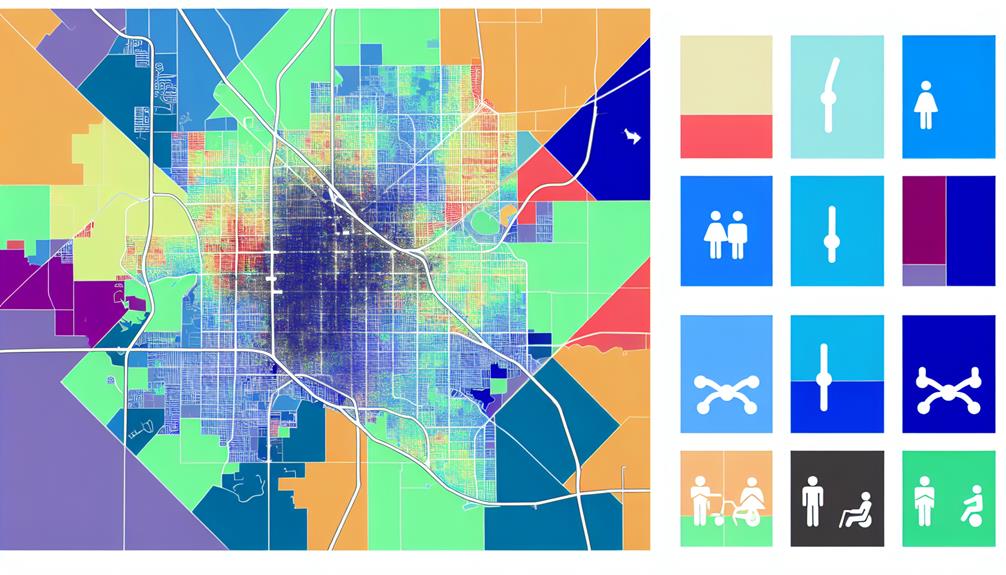

Houston Real Estate Market Overview

Exploring Houston's real estate scene unveils a dynamic landscape shaped by ongoing growth, a burgeoning population, and improved infrastructure, all contributing to substantial hikes in property values and sales activity.

The city's real estate sector has blossomed thanks to enhanced transportation networks, positioning Houston as an appealing choice for investors attracted by affordable living options and favorable mortgage rates.

Between 2011 and 2020, the median home price in Houston skyrocketed by an impressive 68%, accompanied by a remarkable 71% surge in the number of homes sold. This growth is vividly mirrored in the escalating average price per square foot, which surged from $83 to $133 over the same period.

Diverse neighborhoods in Houston, such as Greater Heights, Acres Home, Memorial, Greater Uptown, and Alief, showcase a wide range of home values spanning from $227k to $675k.

The symbiotic relationship between the real estate industry and transportation infrastructure upgrades underscores Houston's status as a vibrant real estate hotspot brimming with promising investment prospects.

Impact of Transportation Infrastructure Improvements

The connection between the improvements in Houston's transportation system and the rise in real estate values offers a fascinating insight into how the city's property market is evolving. Upgrades to transportation, like the METRORail and bus networks, play a crucial role in influencing property values near transit hubs.

Properties located close to major highways such as I-10, I-45, and I-610 experience a boost in value due to improved accessibility and shorter commute times. The presence of toll roads like the Sam Houston Tollway enhances connectivity, making neighborhoods nearby more attractive and consequently increasing property prices.

Transit-Oriented Developments (TODs) near transit stations also play a significant role in driving up real estate values by promoting walkability and reducing the need for cars. Furthermore, upcoming infrastructure projects like the Grand Parkway not only impact current property values but also provide valuable insights into potential investment opportunities and market trends, making them key considerations in Houston's ever-changing real estate landscape.

Accessibility and Property Values

Living near METRORail stations can significantly impact property values in Houston. Homes in close proximity often fetch higher prices due to improved accessibility.

Properties near transit-oriented developments (TODs) also see positive effects on real estate values, reflecting the demand for convenient transportation options.

Major highways like I-10, I-45, and I-610 play a crucial role in property accessibility, further influencing real estate prices in Houston.

Proximity Impact on Value

Living near METRORail stations in Houston can really boost your property value. The convenience of being close to public transportation makes homes in these areas highly sought after, driving up market prices.

Transit-oriented developments (TODs) around these stations create lively communities with a mix of amenities, further increasing property values.

Easy access to highways and toll roads also adds to the appeal of these properties, giving a positive bump to real estate prices.

Keep an eye out for upcoming projects like the Grand Parkway as they can also influence property values in Houston, making the area more accessible and attractive for real estate investments.

Transit Options Influence

When it comes to how transit options like METRORail impact property values in Houston, it's a game-changer. Living near METRORail stations or in transit-oriented developments (TODs) can really boost the value of your property. The convenience of having public transportation right nearby not only makes life easier for residents but also makes properties in Houston more appealing.

On the flip side, homes near highways and toll roads might see their values shift depending on how accessible they're and any associated costs.

As Houston keeps investing in its transportation infrastructure, upcoming projects like the Grand Parkway could shake up real estate values citywide. For homebuyers and real estate investors in Houston, understanding how public transportation options tie into property values is key to making informed decisions.

Demand and Pricing Trends in Houston

Over the past ten years, home values in Houston have soared due to various factors like increased demand and changing pricing trends. From 2011 to 2020, the median home prices in the city shot up by a significant 68%, with the average price per square foot steadily rising from $83 to $133. Factors such as location, condition, and design greatly influence home values in Houston's diverse neighborhoods. The real estate market also saw a remarkable increase in the number of homes sold, jumping by over 71% during the same period, indicating a flourishing real estate scene.

Different neighborhoods in Houston boast varying median home values. For instance, properties in Greater Heights command prices around $675k, while those in Alief average around $227k. The rise in property values can be attributed to changing pricing trends and the escalating demand for housing in Houston. These trends point to a strong real estate market in the city, shaped by a mix of factors that continue to impact pricing dynamics.

Neighborhood Connectivity and Appreciation

Living near METRORail stations in Houston has become a hot commodity, with property values skyrocketing due to the convenience and connectivity these stations offer. Here's what makes these locations so desirable:

- Vibrant Communities: The buzz around METRORail stations is fueled by Transit-Oriented Developments (TODs), creating lively, mixed-use spaces that attract residents and businesses. This mix adds a special charm to the neighborhood and boosts property values.

- Thriving Business Scene: METRORail stations are like magnets for commercial activity, spurring the growth of shops, eateries, and businesses in the area. The easy access to transportation makes these spots prime real estate for entrepreneurs looking to tap into a bustling market.

- Urban Living Appeal: The demand for housing near METRORail routes is at an all-time high. People are drawn to the idea of living in a well-connected area, where public transportation is right at their doorstep. This convenience factor keeps the housing market around these stations buzzing with activity.

Living near METRORail stations isn't just about a place to call home – it's about being part of a dynamic community where everything you need is within reach.

Investor Interest in Transportation-Enhanced Areas

Interest from investors in areas benefiting from improved transportation options has skyrocketed in tandem with the increasing demand and rising property values near METRORail stations in Houston. The easy access and connectivity provided by these transit hubs have drawn investors looking to take advantage of the booming real estate market in these prime locations. Developments focused on transit around METRORail stations have particularly witnessed a significant surge in property values, making them enticing opportunities for investors seeking high returns.

The transformation of once-neglected areas along METRORail routes has further piqued investor interest in transportation-improved regions. Business growth near these stations has also received a boost, adding another attractive element for investors aiming to diversify their investments. Nevertheless, concerns about gentrification and the displacement of lower-income residents in these transit-improved areas highlight the need to implement inclusive development strategies to ensure that the benefits are equitably shared. As investor interest continues to rise in transportation-enhanced areas, it's crucial to strike a balance between economic opportunities and social responsibility for sustainable urban development.

Housing Demand and Commuting Benefits

Improving transportation infrastructure in Houston has a significant impact on housing demand, showing how easier commutes can shape the real estate scene. Here's why it matters:

- Living near METRORail stations boosts property values since people love the easy access and convenience these locations offer.

- Faster commutes from better transportation systems make homes in well-connected areas more popular, emphasizing how accessibility drives housing demand.

- Not only do transportation upgrades increase property values, but they also make neighborhoods more attractive overall. This draws in more buyers looking for convenient and connected commutes.

In my experience, the convenience of efficient transportation links can truly make or break a neighborhood's appeal and property values.

Transportation Infrastructure Influence on Property Demand

Enhancing Houston's transportation infrastructure has a direct impact on the demand for properties in the area. Factors like being close to METRORail stations and having easy access to major highways significantly influence real estate trends.

Properties near METRORail stations are in high demand as they provide convenient access to public transportation, meeting the increasing preference for transit-friendly living spaces. Buyers are actively seeking out Transit-Oriented Developments (TODs) near transportation hubs for their connectivity and commuting ease.

Major highways such as I-10 and I-45 also play a crucial role in shaping property demand in Houston, with neighborhoods offering easy access to these routes becoming more desirable. Additionally, access to toll roads impacts property values by providing efficient transportation options for residents.

Looking ahead, upcoming infrastructure projects like the Grand Parkway are expected to further drive property demand in Houston, underscoring the strong link between transportation infrastructure and real estate dynamics in the city.

Pricing Trends in High-Connectivity Neighborhoods

Living in neighborhoods close to METRORail stations in Houston can really boost property values, and here's why. Firstly, being near public transportation is a huge plus as it adds convenience and accessibility, making these properties more attractive to potential buyers. Additionally, the presence of METRORail stations often leads to the development of transit-oriented hubs, bringing in businesses, amenities, and more residents, all of which contribute to the rise in property values.

What's interesting is that even when the economy takes a hit, these neighborhoods near METRORail routes seem to hold steady in terms of property values. This resilience is largely due to the robust transportation infrastructure in place, which keeps these areas thriving even during tough times.

These trends really underscore the impact that transportation infrastructure, like the METRORail, can have on real estate values in Houston. It goes to show that considering these developments is crucial when making real estate investment decisions.

Real Estate Investment Opportunities in Houston

Houston's real estate scene is buzzing with investment opportunities in diverse neighborhoods. Exploring the trends and emerging hotspots in Houston can offer valuable insights for potential investors eager to tap into the city's vibrant real estate market.

By grasping the market pulse and understanding the factors driving growth in specific areas, you can make well-informed decisions when considering real estate investments in Houston.

Let's delve into the dynamic landscape of Houston's real estate market to uncover promising opportunities and strategic moves for investors.

Houston Market Overview

Looking to invest in real estate in Houston? You've got a range of options to explore across different neighborhoods, each with its own unique charm and potential for growth. Here's a closer look at what Houston's real estate market has to offer:

- Neighborhood Diversity: Whether you're eyeing the affordable vibes of Alief with a median home price of $227k or the upscale allure of Greater Heights at $675k, Houston's neighborhoods cater to various budgets and tastes, offering a diverse array of investment opportunities.

- Consistent Market Growth: Houston's housing market has shown steady progress, with a significant 68% increase in median home prices from 2011 to 2020. This reliability makes it an appealing choice for investors looking for long-term appreciation potential.

- Factors Driving Demand: The city's growth in population, job market, and ongoing infrastructure enhancements all play a role in fueling the demand for real estate investments in Houston. These factors paint a positive picture for investors seeking opportunities in the area.

Investment Trends in Houston

Houston's real estate scene is buzzing with excitement, drawing in investors on the hunt for profitable opportunities. The current trends in real estate investment in Houston paint a picture of a vibrant market teeming with potential in residential, commercial, and mixed-use properties. Factors like the city's growing population, job market, and infrastructure upgrades all contribute to the allure of investing in Houston's real estate.

The market has been steadily expanding, reflecting a rising demand for various types of properties. Additionally, Houston's affordable living costs and attractive mortgage rates make it a prime destination for investors seeking a slice of the action in a thriving market. These trends point to a robust investment environment in Houston, promising attractive returns amidst the ever-changing real estate landscape.

Growth Areas in Houston

In Houston's ever-evolving real estate scene, some neighborhoods truly shine as excellent investment opportunities, each with its unique appeal based on average home values that cater to different investor preferences. When diving into real estate investment in Houston, it's worth exploring the following promising areas:

- Greater Heights: This neighborhood offers high-end housing options with an average home value of $675k, making it an ideal choice for investors seeking upscale properties.

- Acres Home: With an average home value of $339.9k, Acres Home presents affordable real estate investment opportunities, perfect for those looking for cost-effective housing options.

- Memorial: Boasting an average home value of $599k, Memorial is an attractive area for upscale real estate investments, showing potential for commercial development.

Each of these neighborhoods holds its unique charm and investment potential, providing a diverse range of options to suit different investment strategies and goals.

Frequently Asked Questions

How Do Transportation Infrastructure Improvements Affect Rental Property Demand in Houston?

Improving transportation infrastructure in Houston tends to drive up demand for rental properties. Better connectivity attracts tenants looking for convenience, which can lead to higher rental prices and increased property values. Staying updated on upcoming developments can help you take advantage of this trend and make the most of your investment opportunities.

Are There Any Specific Neighborhoods in Houston That Have Not Experienced Property Value Appreciation Despite Transportation Enhancements?

In certain Houston neighborhoods, property values haven't quite caught up with the improvements in transportation. Things like the condition of properties, nearby amenities, and current market trends all play a role in how much a property appreciates, leading to differences in growth rates.

What Are the Potential Drawbacks of Increased Accessibility Due to Transportation Infrastructure on Real Estate Prices?

Improving transportation infrastructure can really boost accessibility and even drive up real estate prices. But, it's not all sunshine and rainbows. There are some downsides to consider, like gentrification, pushing out lower-income folks, and inflating property values, which can make housing less affordable for some members of the community. It's a mixed bag of benefits and challenges that come with these improvements.

How Do Transportation-Related Disruptions Impact Real Estate Investment Returns in Houston?

To really grasp how disruptions in transportation can shake up real estate investments in Houston, it's crucial to observe how market dynamics shift in the wake of these interruptions. By understanding how changes in accessibility can directly impact property values, you'll be better equipped to make informed investment choices. It's like seeing the ripple effect firsthand – where alterations in transportation routes or options can either boost or deflate the value of your real estate assets. So, keeping a close eye on these correlations can be a game-changer when it comes to your investment strategy in the Houston real estate market.

Are There Any Government Policies or Regulations That Could Potentially Affect the Relationship Between Transportation Infrastructure and Real Estate Prices in Houston?

When looking at how government policies or rules impact the connection between transportation infrastructure and real estate prices in Houston, it's key to dive into data trends and predict future market shifts. This analysis gives a clear picture of how regulations shape the real estate landscape. By keeping an eye on these trends, you can make informed decisions in the ever-evolving real estate market.